The first thing to decide is whether you need to hire a bookkeeper full time or engage someone on a temporary or temporary-to-hire basis. You could use a specialized staffing agency to find skilled candidates who would be a solid match for your company until you’re ready for a full-time hire. A talented bookkeeper can save you time, provide useful business reports, share insights and alert you to red flags, and help you manage your cash flow.

What Will a Financial Background Check Show You?

Before you take on any small-business bookkeeping tasks, you must decide whether a single- or double-entry accounting system is a better fit. The entry system you https://www.quickbooks-payroll.org/ choose impacts how you manage your finances and how your bookkeeping processes will work. Single-entry bookkeeping records all transactions in just one row.

Transitioning from bookkeeping to accounting roles

With access to 1M+ customer reviews and the pros’ work history, you’ll have all the info you need to make a hire. Forensic accountants investigate financial crimes involving fraud, embezzlement and other issues. They often work closely with law enforcement and lawyers, and they can help determine the legality of financial activities, according to the BLS. Check out the average hourly rate for accounting services in your area. If you invoke the guarantee, QuickBooks will conduct an evaluation of the Live Bookkeeper’s work. Let’s explore what bookkeepers do, some of the benefits of bookkeeping, and your options for using a bookkeeper.

Payroll processing fundamentals plus 10 steps to get this process right

This level of knowledge serves the business owner well when they are ready to delegate the bookkeeping process to someone else. Many think bookkeepers fall into the category of data entry or administrative clerks when in reality, bookkeepers are typically financial service professionals. Working as a freelance bookkeeper means you’re an independent business owner who contracts out their services to other business owners. You get to set your rates, work on your own schedule, and grow your business how you want.

You can also hire a bookkeeper to work directly for your business. If you go this route, make sure to brush up on interview questions that’ll help you determine who’s the best fit. Here’s a crash course on small-business bookkeeping and how to get started. Certifications aren’t necessary to become a bookkeeper but can signal to employers that you have the training and knowledge to meet industry standards. After you have a few years of experience, you can earn the Certified Bookkeeper designation from the American Institute of Professional Bookkeepers by passing a series of exams.

QuickBooks Support

Mostly every business could find value in having someone look after their financial books and records. But as with any other enterprise, running your own bookkeeping business takes some key elements of preparation and knowledge. Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager.

Detail-oriented individuals who enjoy problem-solving, math, and computers may want to become bookkeepers. The Bureau of Labor Statistics (BLS) projects that jobs for bookkeepers, accountants, and auditing clerks will decline by 6% from 2022 to 2032. However, the profession will still add 183,900 openings annually to fill roles held by retirees or job changers. The time a bookkeeper puts into your business is determined by how many transactions you process per month, whether you have employees, and how complex your industry is. Medium to large enterprises need one for budgeting and forecasting.

Also, if you have catch-up bookkeeping for them to complete, that will be an additional, one-time project that they need to handle. We’ll show you a few things to keep in mind so you can identify which bookkeepers are the best fit for your small business. Bookkeeping professionals can do a regular expense review and follow up on overdue payments. You can use either the virtual option or a professional service to get timely insights and quick responses to urgent matters.

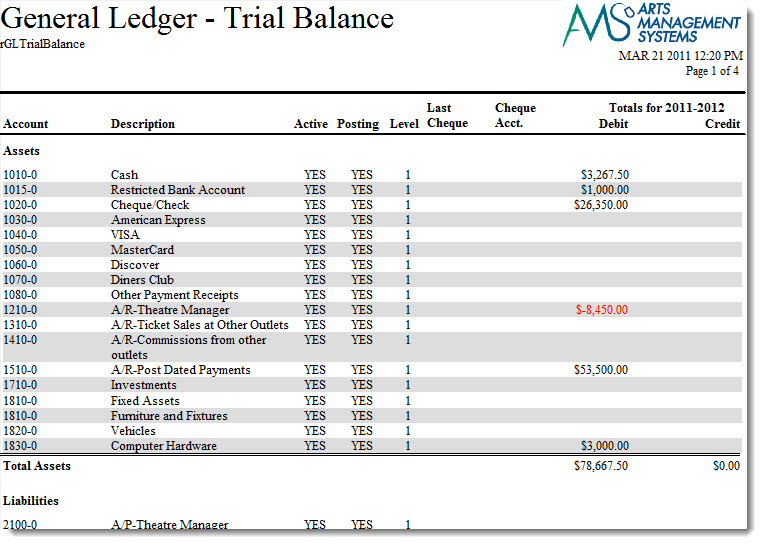

Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries. Find out more on bookkeeping accounting skills, how to earn accounting degrees and bookkeeping certifications, getting jobs, salary expectations, and more. You should also browse the chart of accounts and make sure it’s organized in a way that makes sense for your business.

She has a deep passion for technology and a keen understanding of the HR and payroll industry. Throughout her career, she has diligently stayed up-to-date with the latest advancements in HR and payroll software, constantly exploring new https://www.kelleysbookkeeping.com/restitution-and-unjust-enrichment/ features, trends, and emerging technologies. The amount you choose will vary based on your company’s location, the experience you’re requiring, whether they’re contractors or employees, and the industry in which your company operates.

Though unlikely, there’s still a lot riding on the accuracy of your bookkeeping. It’s best to invest in a professional who can ensure things are done correctly. Some bookkeepers would have you believe that bad bookkeeping can sink your business. Although bad bookkeeping has led to the occasional business failure, the consequences are usually not quite so dire. By not doing the bookkeeping yourself, you will lose some intimate knowledge of your business’s finances. These are just a few of the ways a professional bookkeeper can be a money-saving investment in your business.

- Online bookkeeping courses are the fastest way from zero experience to paid work, but there’s a ton of free content online if you want to learn on your own.

- Many companies have a background check policy to run a criminal background check on all new hires.

- But what do all of these figures mean, and where do you go from there?

- It’s best to invest in a professional who can ensure things are done correctly.

We offer a full guide on how to write a job description, but there are a few points we want to call out here specifically for bookkeeping. As stated, it’s dependent on your company’s needs and how you plan to grow your business. Even if you choose to have a tax preparation professional handle filing for you, working with a bookkeeper throughout the year can help ensure your books are clean and ready come tax time.

You will need to learn how to start a bookkeeping business in your location, such as how to file for a license if you choose to have an in-person office. Employers also prefer to hire bookkeepers who have taken some postsecondary courses. So, some professionals may pursue certificate programs irs still working on last year's tax returns may extend 2021 tax deadline in bookkeeping as a degree alternative. This lets them avoid the kinds of service gaps that may crop up with an individual freelancer. If you’re worried about not having someone you can count on everyday, and don’t mind paying a bit more, a bookkeeping firm is a smart choice.

Below is a sample bookkeeper job description that you can customize to meet the needs of your business. Outsourcing your bookkeeping is another option, and this guide on how to find the best virtual bookkeeping service can help you get the process started. At the same time, businesses need to make sure they pay their own bills on time to avoid late fees and maintain a solid reputation. These expenses that haven't been paid yet are categorized as accounts payable.

Accountants are often asked to interpret complex data and analyses, with duties such as producing profit-and-loss statements and filing taxes. Financial accountants calculate assets and liabilities and show outside investors how a firm is doing. Cost accountants analyze financial processes within an organization and makes recommendations for improved cost control management. If you started your own business, it’s likely that you’re passionate about running it and concentrating on the tasks you love doing. But if you’re like most business owners, you’re not so interested in recording all the details of every financial transaction.